#3: Forced transformation

In business matters, I’ll keep it short on Corona, as there are lots to read on it anywhere on the...

Tiktok makes the headlines on many an article now and not a few professionals are wondering, whether they need a strategy. A lot of the attention on Tiktok and not least its user growth stems from paid ads on a big scale. It's not exclusively an organic growth loop thus it's impossible for retention to be very good. Some say it's just an attention trap with no value in itself while others see it as the future school of mobile videography. Whatever. The stronger inhibitor for its growth in my view are future legal headwinds from regulators. In Europe or across the Atlantic they've all busied themselves with Facebook or big tech recently and Tiktok hasn't come to attention yet. But it will not enjoy such a long unchecked period as GAFA did. Regulators will not leave Tiktok unchallenged on content policy, Chinese censorship and data flows if it continues its success. What if Tiktok wants to start its own Libra?

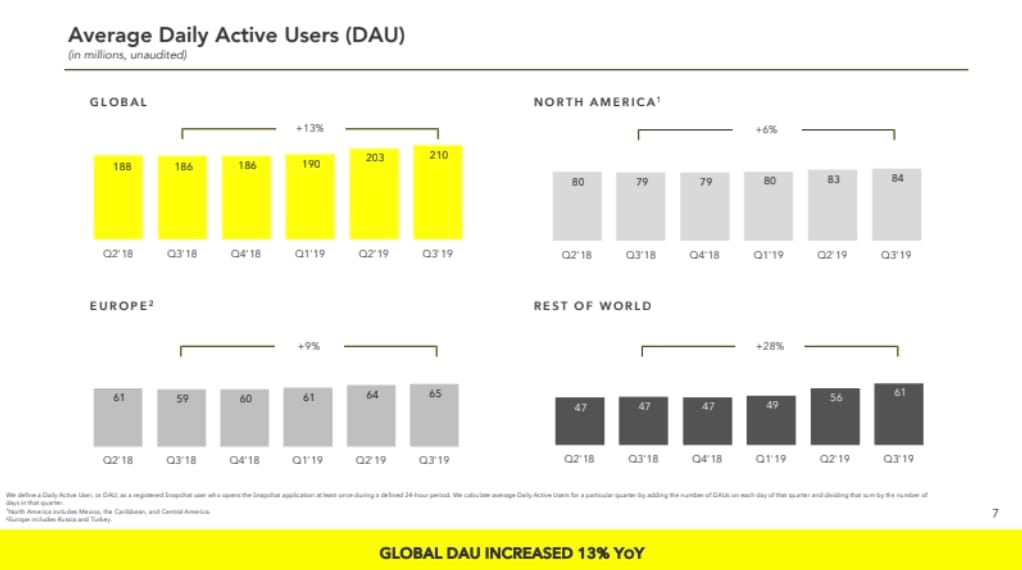

Snapchat continues its comeback:

After positive numbers for Q2, largely attributed to one successful filter and an app redesign, Q3 shows further user growth, especially in the rest of world and activity in stories. Stories viewership means ad views for Snapchat, hence good business news for them. Snap's other big asset is Discover which grew 40% yoy and needs to be built out further as Snap can't rely on ephemeral messaging (stories) only, now that Instagram came out with Threads (scroll down). For marketing, Snap is sometimes seen as awareness placement, rather than website conversions, but now they've launched dynamic (product) ads. It might become very interesting (again).

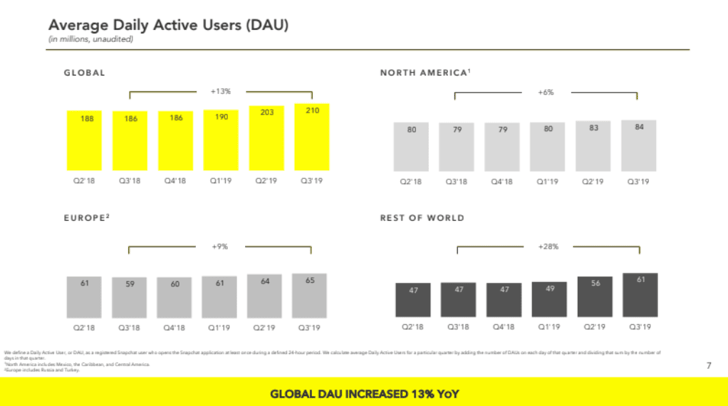

Instagram launched a new app called Threads.

This is a spin-off of the regular Instagram app, focusing on communication (Stories, videos, images) on users' close friends' lists, with a dedicated inbox and notifications. This is aimed at Snapchat too or more broadly the user behaviour Snap tied down with its ephemeral stories/messaging and streaks. It might serve as a blueprint app for influencers too, who have already been charging users to list them on their close friends' list since the close friends' feature has been released late last year - but this is just my shy idea :)

There’s a study from Facebook on GenZ. While I think these generation-attributions are oversimplifications, this report provides insights like these:

Clothing retailer ASOS created a youth-focused fashion line called Collusion, where everything is sustainable, animal-free and gender-fluid. Through a poll in an Instagram Stories ad, the brand discovered nearly two-thirds of respondents felt that clothes should not be gendered, providing insight into its customers and guidance for the retailer’s concept.

Product and marketing might look completely different.

With the holidays season approaching, i.e. Black Friday and Christmas, CPMs are going to fly high. On a micro level, CPMs for target groups may be up for a rollercoaster ride. If your plan is to power through with your own ecom-efforts, there are some pointers from Facebook [pdf] and Smartly. If you don't have to be live during these peaks, go small or off and come back on the 24th of December, when all of e-commerce is done and out for Christmas. Advertising after Christmas and into January gets you the cheapest CPMs all year round.

As a companion to pixels/cookies on websites that are increasingly being blocked by browsers, Facebook is building up a server-2-server solution that sends signals from the advertiser's backend to Facebook's server via API calls. Together with regular pixels, this makes for a stronger signal which in turn helps to increase efficiencies, i.e. drive down costs. Only supported for advertisers working directly with Facebook as of now, however, the roadmap “looks healthy". Every advertiser looking beyond platform KPIs like views and reach should get on top of this.

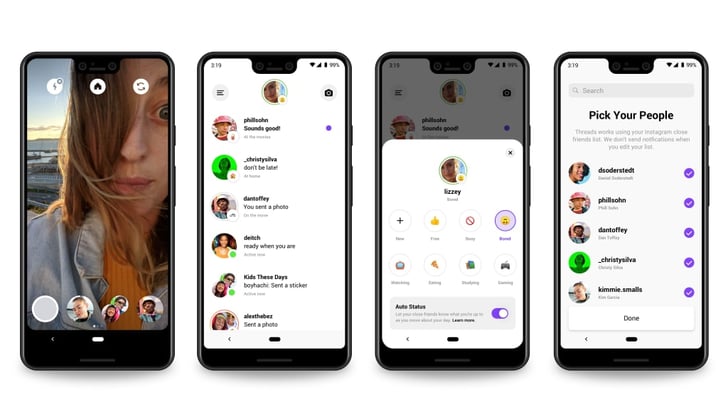

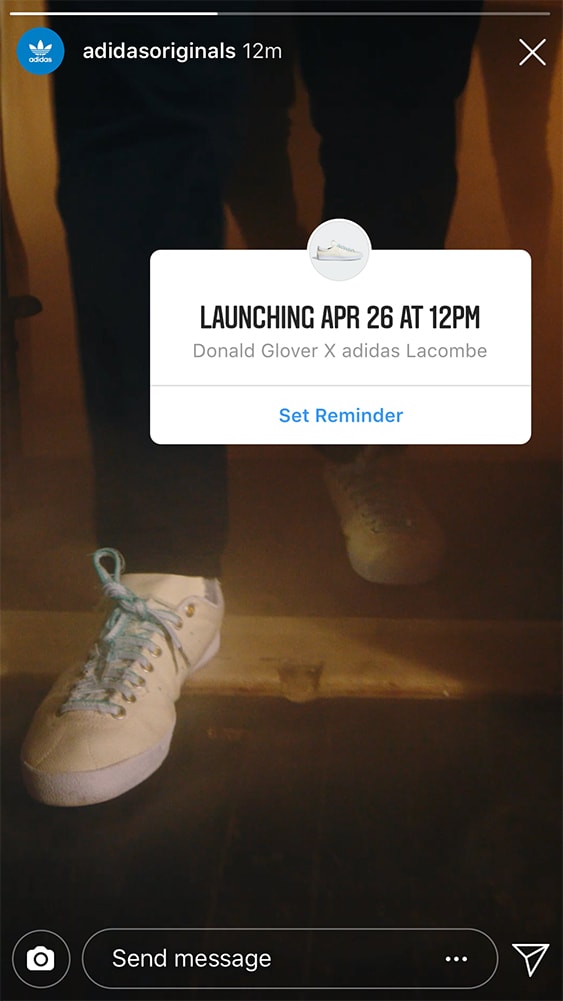

One of the reasons why people follow brands on Instagram is to keep up to date with things and discover new products – and ideally before anyone else. To help businesses keep people in the loop, Instagram tests a product launch sticker in Instagram Stories and a product launch tag in the feed that lets people set reminders for the launch date, preview product details, and buy as soon as a product is available without leaving Instagram. This is part of the closed Instagram Checkout beta in the US:

With Snap’s comeback and Pinterest’s growth, attribution across mobile apps becomes even more difficult. How to attribute the success of your mobile Facebook/Snap/Pinterest campaigns and make them comparable with the ones on Google SEA? There is not one tool out there that successfully does this. The issue is that marketing platforms, which are operating in their own, closed ecosystems would need to explicitly provide features to infuse view-tracking-tags by third-party systems, in order to track views from users, who are seeing ads on one of these platforms. This is not happening, so we are left with Google's cookie-based and Facebook's user-based tools.

Try Facebook's free Attribution tool for a starter - another option is to work with a lift test calibration method across platforms. With lift tests, you generally measure the ratio between attributed and incremental conversions. You can then take this ratio and turn it into a multiplier. Whenever you collect new attributed results, the multiplier is applied to convert the attributed conversions into estimated incremental conversions per channel.

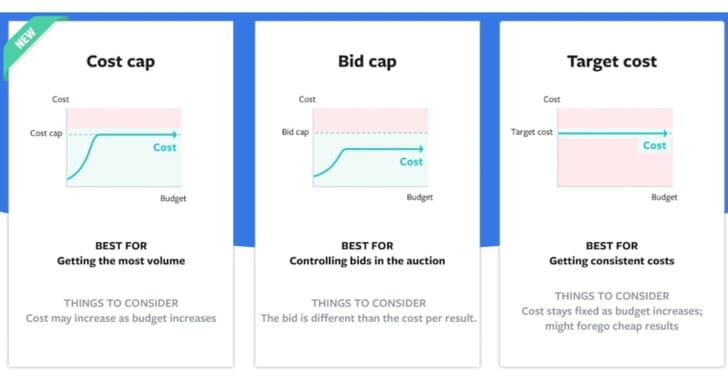

Speaking of holidays season price hikes, cost cap-bidding may help. Or target cost or bid cap. I had the chance to talk to the responsible Menlo Park product team recently and my takeaway was that these cap strategies are underappreciated.

Most advertisers are going with the lowest cost though and yes, who doesn't want lowest cost? But there are products/offers no one buys online or where the consideration cycle is too long to be effectively captured by a single link ad magically appearing in the newsfeed. One thing is using lead ads to take the sales cycle offline and another thing is to work with a cost cap. If your product is a Steinway or Audi and you are utilising lead ads, you could set a cost cap of say 500€ for a lead and still be profitable. It's valuable information for Facebook if you are willing to pay as much, rather than the lowest cost for a lead which I would naively assume to be somewhere between 1 and 20€ CpL. Facebook optimises delivery within target groups depending on bids. Also, it might be worth testing the cost cap once you’ve exhausted your audience because the superior information that you are willing to pay 500€ a lead will give you a different slice of the target group.

As this will be the last issue for the year 2019, I wish you a merry Christmas and a happy new year :)

In business matters, I’ll keep it short on Corona, as there are lots to read on it anywhere on the...

Welcome to the first installment of The attribution of ROAS on paid social and beyond. Let me know...

Executives have always dreamed of a "single source of truth" to measure marketing performance and...