Hello!

I hope this newsletter finds you well.

It comes somewhat delayed as I moved flats and moved all my virtual assets over to HubSpot too. Complete new website, success stories and everything. Have a look: fiegenbaum.solutions

The main deal stays the same: No agency, only Chefbehandlung 🧙

Let's have a look at what happened in between:

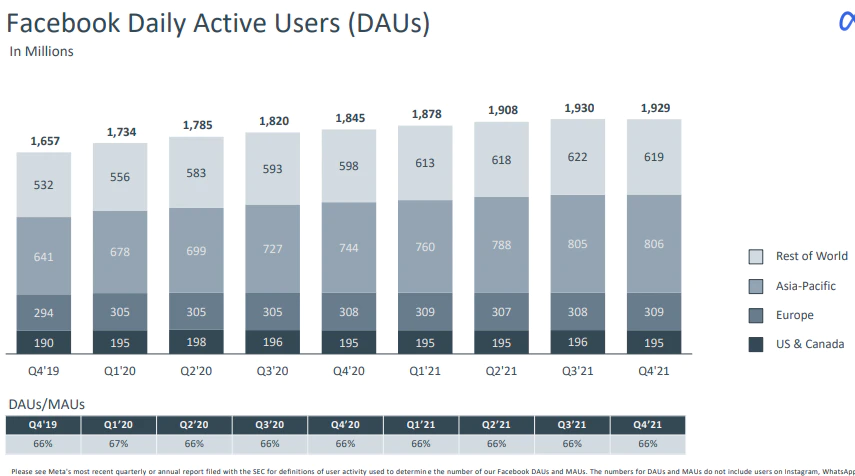

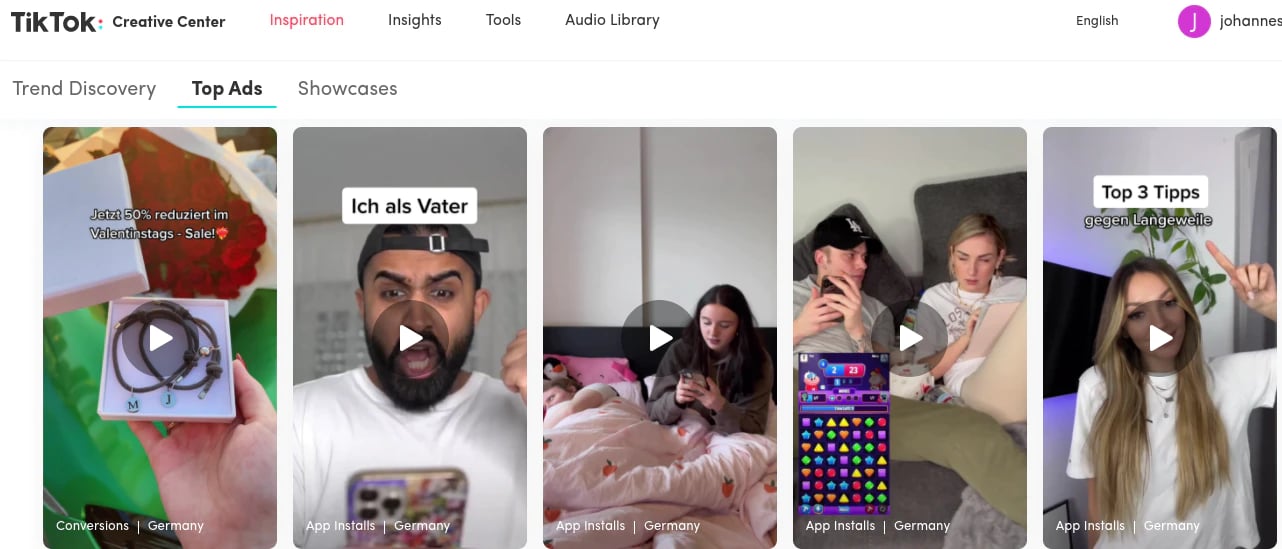

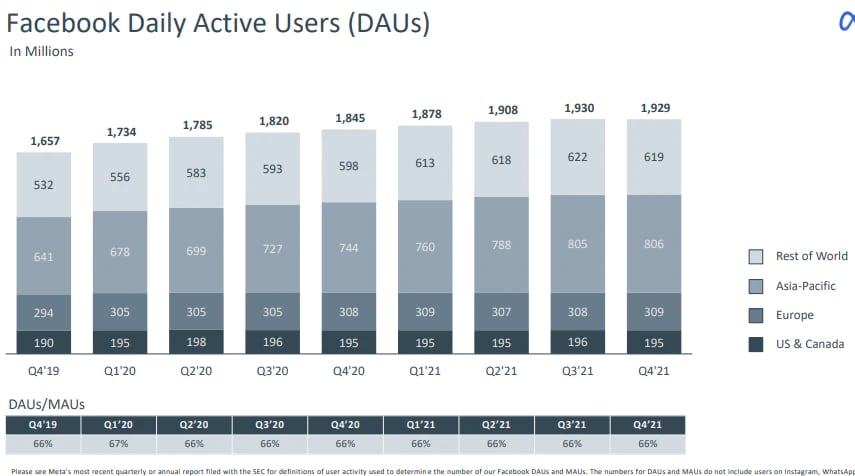

- Meta announced in its Q1 earnings call that Facebook’s user and revenue growth record comes to an end.

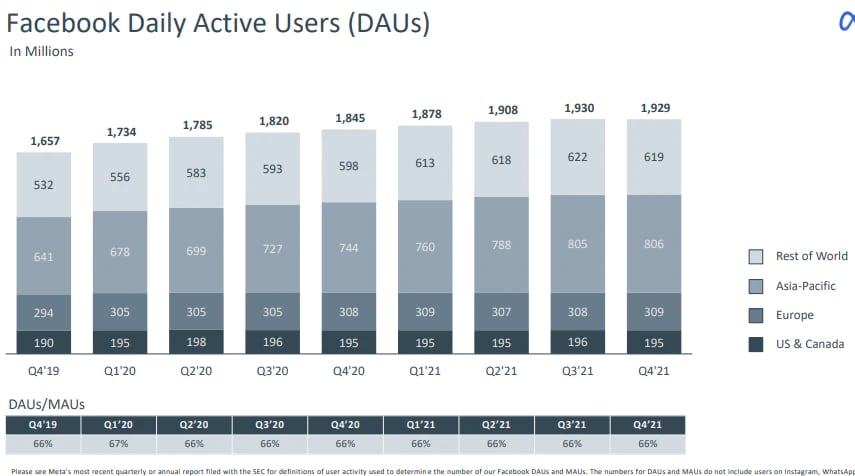

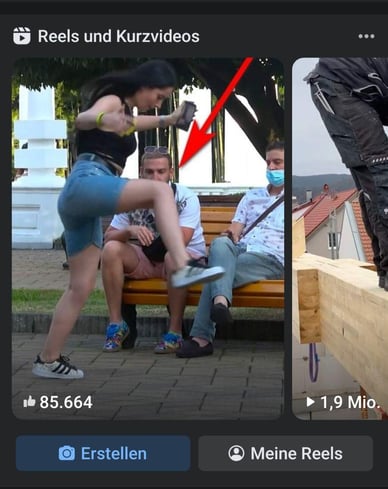

Available impressions are no longer growing as user growth flat lines, but still more advertisers will bid up auction prices: CPMs will increase. It’s a matter of engagement and product innovation for Meta, where innovation really means short form video, i.e. TikToks. Now, Meta has brought short form video to the blue app front and center and CPMs on ads are spiking, because reels are receiving a high impression share from users that is missing on other ads placements. The challenge for Meta is that they haven't scaled ad units on reels - they are moving vast proportions of their traffic on to "free" inventory. Advertisers need to think about short-term video and adopt UGC concepts to set themselves up for reels ad units scaling up.

Content is here, no ads yet:

Watch out for Meta's Q1 numbers this Wednesday/Thursday.

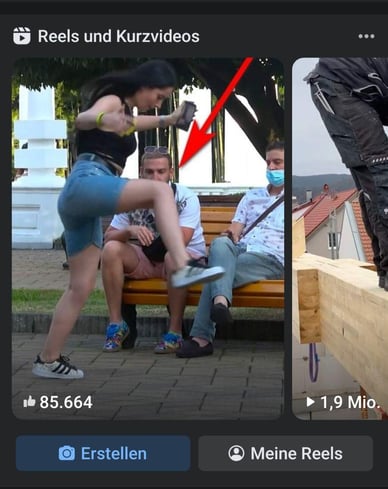

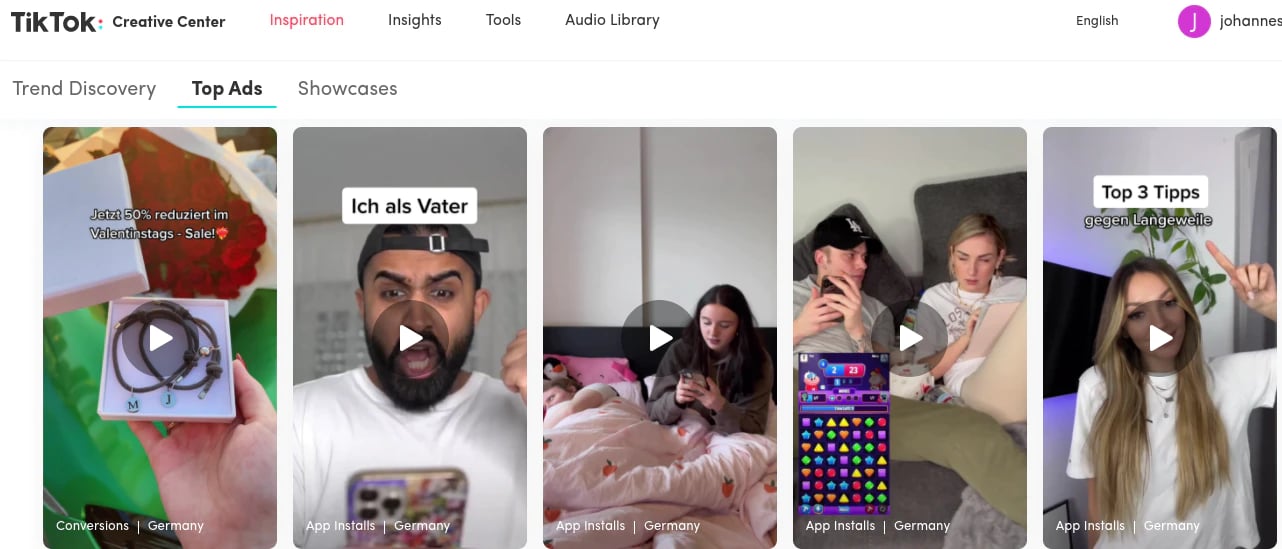

- From what I’ve seen so far, advertisers struggling with iOS14 changes are moving budgets to Alphabet. And then there’s TikTok as the rising star. Despite all the talk about followers and organic reach, its ad placements are still some way off from a natural user experience delivering positive return for most advertisers. Have a look at TikTok's Creative Center to find creative inspiration for paid social. Filter by country, objective and sort by reach and you can immediately see what’s currently spending (and probably making a positive return):

- For advertising on Facebook and Instagram it’s an absolute requirement to work these as best as you can. A mature ad offering with fierce competition and high CPMs is not a place to dip your toes in. It needs to be setup for success (think Creatives, Conversion API, Landing Pages, Retention via Email/CRM) and professionally executed. I am offering audits to help here.

- One area for exploration other than TikTok is Snap. But even though they posted theirfirst net profit ever for Q4, I was surprised to learn thateven Stories on Snap are seeing less engagement as users are flocking to Spotlight, their short form video destination. Then there are Pinterest and Reddit too. So it comes down to creative capabilities and product channel fit. A product that needs a bit more context probably shouldn’t be advertised on TikTok or Snap. But still, if you are able to learn on these platforms and especially short form video, first-mover advantages will be yours.

- Apart from checkups and execution, there were quite a few Conversion API-integrations I did for various verticals.

While most tend to rely on their existing tech stack to quickly get Conversion API up and running, platforms like Adobe, Tealium or Singular are seldom up to the task. Legacy configs, a lack of transparency and support dependencies delay and complicate go live.

My go to options are either Google’s Server-side Tagging or Meta’s API Gateway. They work by copying the client-side pixel parameters and pushing it from the front end to a server end point. This is not a pure 100% server-side solution but easy and quickly to setup. You can of course opt for a 100% custom code setup, which takes longer and is more expensive in terms of dev coins, but makes more sense if you are wiring up TikTok, Snap and Pinterest at the same time.

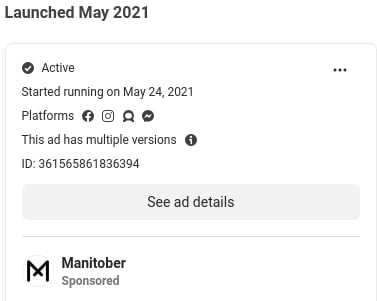

- Good to know: A quick way to check how advanced competitors are running ads on Meta is to check the ads library, looking for the following:

Started running: This has been live for quite a while so must be a successful ad.

Platforms: Has selected all placements, which, when done well, averages out risk and cost.

This ad has multiple versions: They are using dynamic creative features, which you don’t switch on by accident.

Hover over the CTA and you can check their UTM-parameters, deciphering how they structure their ads and account.

The ads library is here.

- A major headache for most advertisers has been iOS14 and reporting. Currently there is no silver bullet to circumvent iOS14 imposed limitations (Conversion API falls under the same limitations). So while the social platforms’ reporting has at least been more helpful than last-click web analytics to assess performance, there’s now less data to be found in the respective ads managers than in web analytic dashboards 😱

What I work with is four things:

-

-

Private Lift based on Conversion API to test for incrementality.

-

Post-Checkout-Surveys asking “Where did you hear about us first?” to attribute for views. Pretty low-tech, yes I know.

-

Marketing efficiency ratio, in short MER, dividing net revenue by platform spend and then looking for patterns across the different platforms.

-

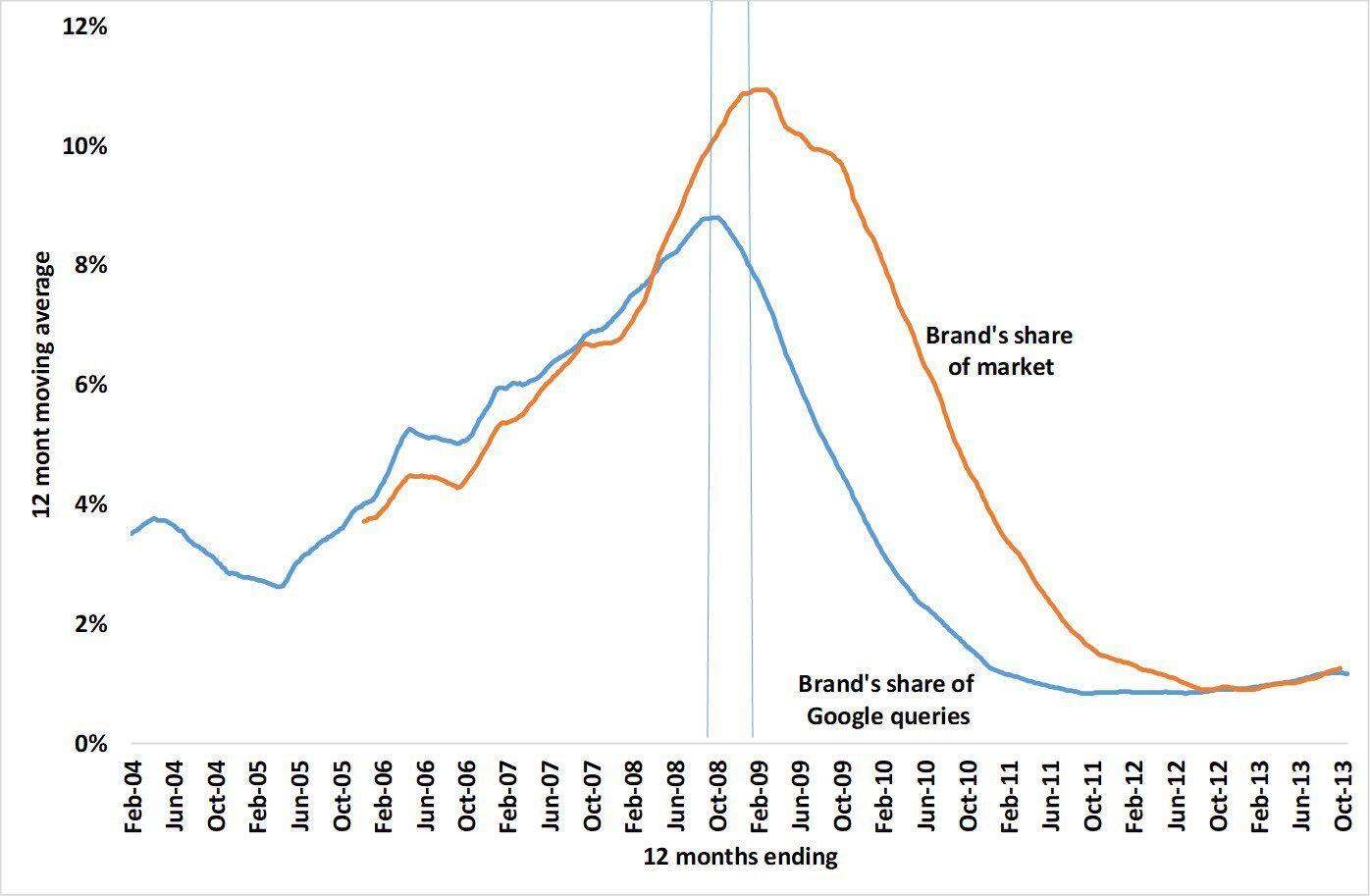

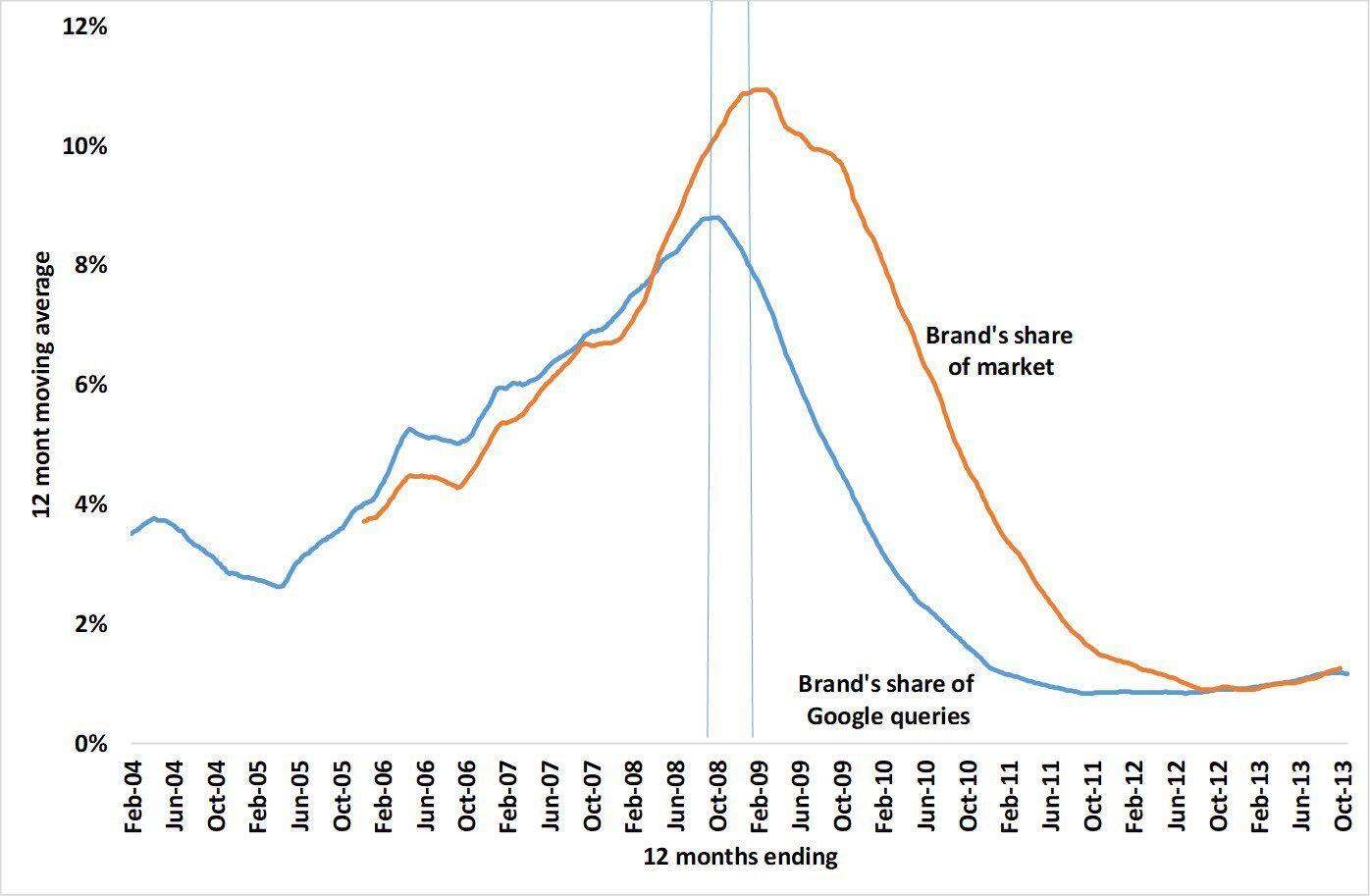

Share of search, a method that uses Google Trends to compare search queries for brand A against a baseline of summed up competitior queries as a gauge of market share. Brands with a higher share of search relative to their market share will gain market share in the future, would you agree?

An exhaustive guide can be found over at Reforge.

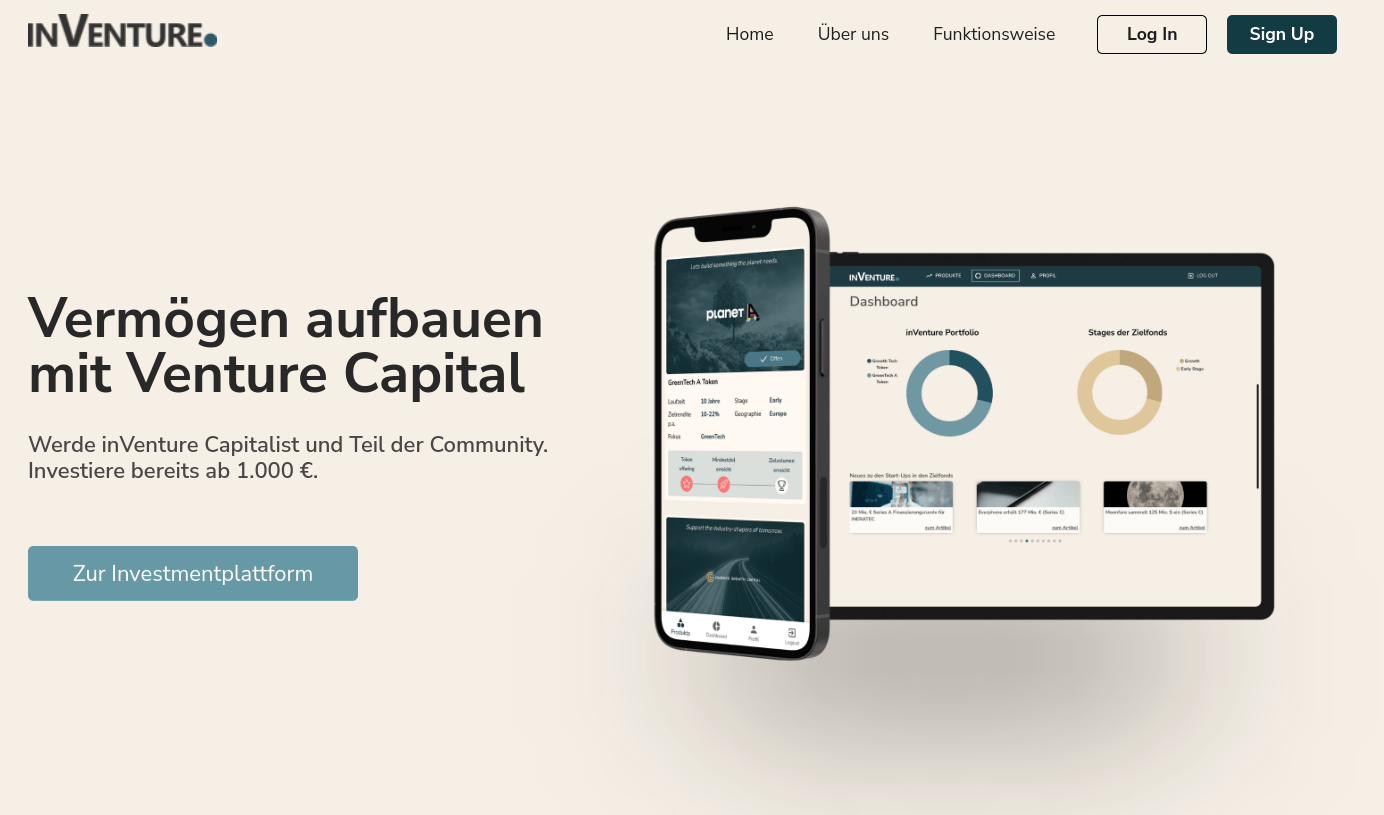

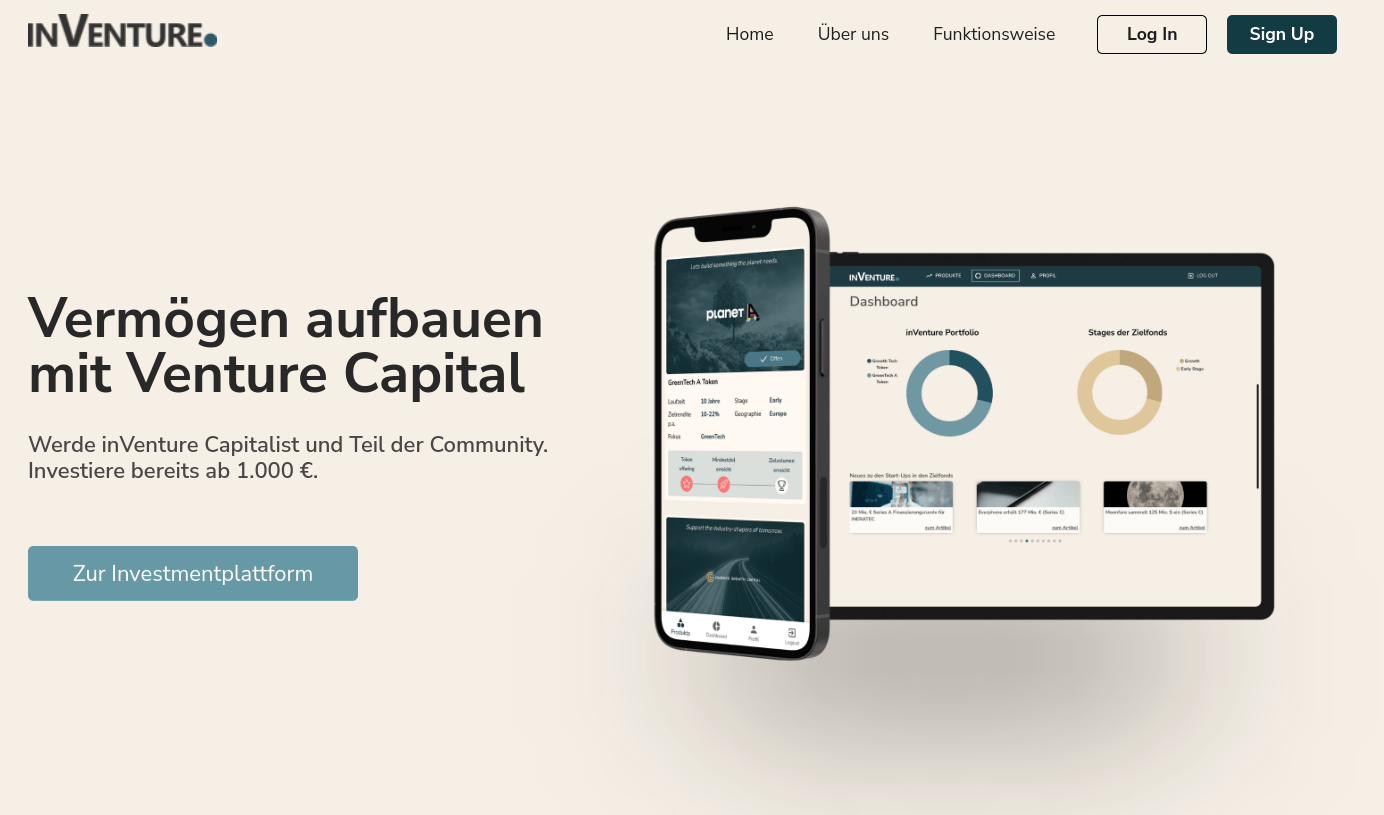

- One client I have been working with intensively over the last few months is inVenture. As a first for Germany, they are offering access to venture capital investments starting at 1000€. If you are looking to spike your investment strategy with diversification and potentially higher returns then please have a look. They are currently offering two venture fonds: Planet A and Cadence Growth Capital. Both will be closed soon-ish.

That's it :)