7 min read

Hamburg 2040: Pioneering Strict Climate Regulations for Business Transformation

By: Johannes Fiegenbaum on 10/15/25 4:28 PM

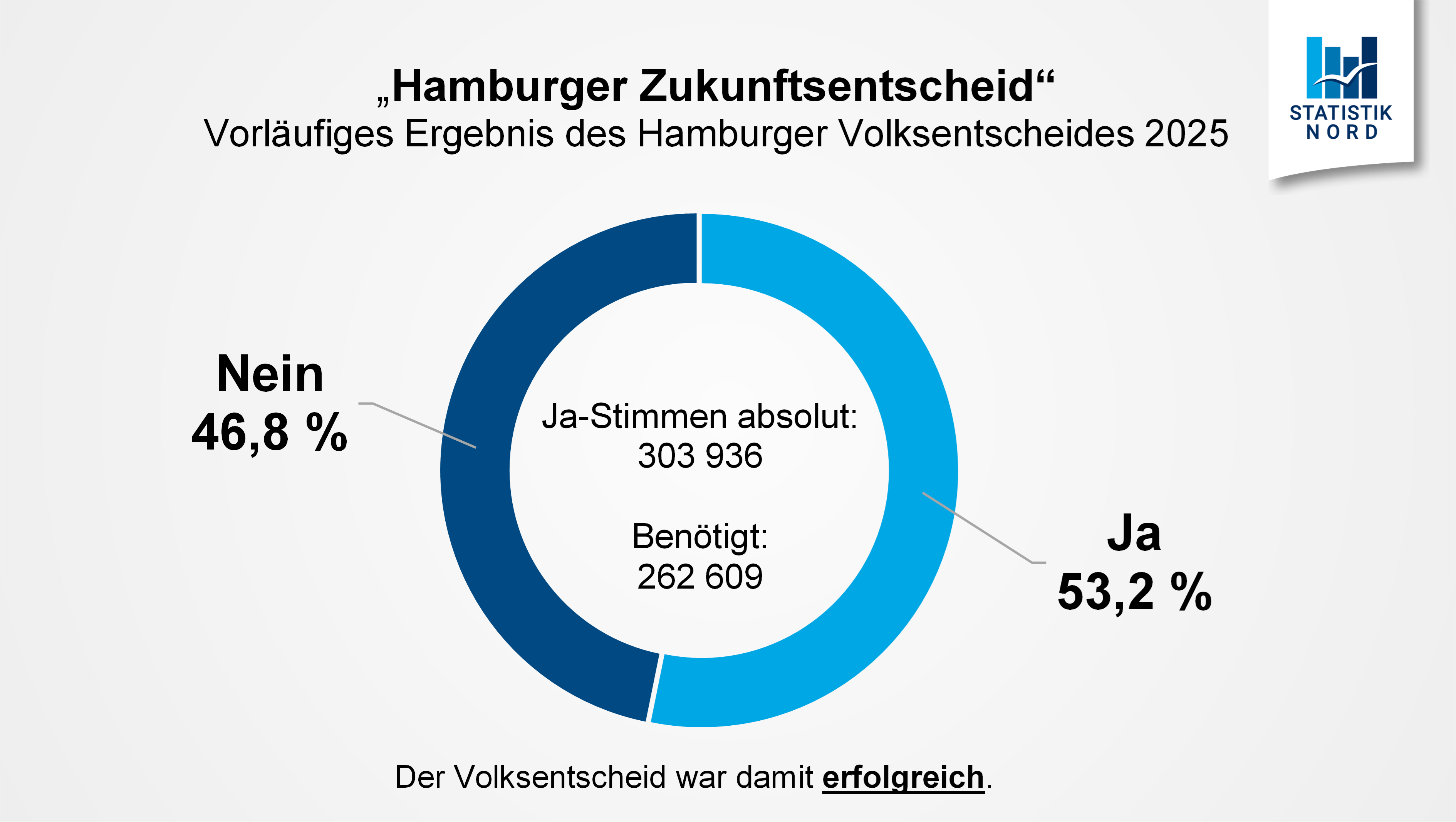

The Hamburg Future Referendum of October 12, 2025, accelerates Germany's climate action timeline by five years earlier. The Free and Hanseatic City commits to reach climate neutrality by 2040 – establishing Hamburg 2040 as Germany's most ambitious climate protection framework with binding annual emission budgets and automatic immediate action.

Executive Summary: Three Strategic Implications for Your Business

1. Binding Annual Budgets: Hamburg 2040 introduces exponentially declining CO2 budgets from 9.6 million tons (2026) to 424,000 tons (2040). The final five years require halving remaining emissions from 2035 levels.

2. Automatic Immediate Programs: Budget overruns trigger mandatory adjustments within five months – from stricter industrial requirements to accelerated heating replacement obligations.

3. Complete Gas Phase-Out: All fossil fuel boilers must be replaced as Hamburg shuts down natural gas distribution. Commercial properties face five- to six-figure investments with funding up to 70% for medium-sized enterprises.

What Is Hamburg, Germany Famous For? Economic Context for Climate Action

Hamburg's economy centers on its status as Germany's second-largest city and Europe's third-largest port. The Hamburg Port handles over 8 million containers annually, making port policy central to the city's climate strategy. The Free and Hanseatic City ranks among Germany's wealthiest regions, with GDP per capita exceeding €66,000.

The Hamburg Chamber represents 170,000 businesses spanning maritime logistics, e-commerce distribution, renewable energy technologies, and financial services. This diverse economy creates unique challenges for reaching climate neutrality – particularly balancing port development with emission reduction targets.

Is Hamburg a Green City? Current Climate Protection Status

Hamburg reduced emissions by 46% since 1990 through coal phase-out and improved energy efficiency. However, achieving net zero by 2040 requires dramatically accelerated transformation. Hamburg Port logistics and heavy truck transport create significant challenges, while existing heating infrastructure relies on natural gas. The circular economy transition offers opportunities through Hamburg's industrial infrastructure supporting resource recovery and waste heat utilization at scale.

Port Development Plan: Strategic Infrastructure for Climate Neutrality

Hamburg's Port Development Plan integrates climate targets with economic growth ambitions through shore power expansion for ships, hydrogen infrastructure for import terminals, rail connectivity shifting cargo from trucks, and circular models establishing industrial symbiosis zones. The Hamburg Port must reach net zero while maintaining competitiveness against Rotterdam, Antwerp, and other European ports through coordinated investment from city government, port operators, and private sector businesses.

The New Control Architecture: From Reduction Path to Annual Budget

Hamburg 2040 introduces binding annual emission budgets declining from 9.6 million tons (2026, 53% reduction vs. 1990) to 424,000 tons (2040, 98% reduction). Critical: The final five years require reducing 2.2 million tons – more than half the amount remaining in 2035. This exponential trajectory forces early action rather than back-loaded efforts.

Annual Estimated Balance: Faster Data Creates Planning Certainty

The new estimated balance system delivers data by June 30 for the previous year – creating visibility of budget overruns within twelve months. Immediate programs trigger automatically if budgets are exceeded, while businesses gain earlier signals about regulatory tightening. The five-month response deadline leaves limited room for delays.

Strategic Implications by Company Size

Startups: Climate Neutrality as Competitive Advantage

Hamburg's climate action accelerates investor expectations for ESG readiness. Startups benefit from clean-slate infrastructure without legacy fossil fuel systems, attracting climate-conscious skilled workers while meeting investor requirements for climate risk assessment. Use the ESG Investment Quick Check to establish your baseline and identify priority areas.

Medium-Sized Enterprises: Funding Opportunities Meet Transformation Pressure

Hamburg's business models in medium-sized enterprises face significant but manageable transitions to reach climate neutrality. Energy efficiency improvements and new business models create competitive advantages while meeting Hamburg 2040 requirements:

- Buildings: Replace gas heating with heat pumps achieving significant energy efficiency gains (up to 70% funding for SMEs)

- Fleet: Electrify vehicle fleets with charging infrastructure support to reach climate neutral operations

- Energy efficiency: Process optimization through energy efficiency measures reduces costs while cutting emissions

- Supply chain requirements: Major customers increasingly demand emission transparency as they reach climate neutrality

A corporate carbon footprint identifies where investments deliver both emission reduction and economic returns, supporting medium-sized enterprises to reach net zero profitably.

Corporations: Climate Neutrality as Strategic Test Lab

International companies with Hamburg locations face overlapping pressures from CSRD reporting, supply chain requirements, and climate liability risks. Hamburg 2040 becomes a test lab for EU-wide climate strategies. A systematic climate risk assessment evaluates both physical and transition risks at Hamburg locations.

VCs & Impact Investors: Portfolio Climate Exposure

Venture capital funds with Hamburg portfolio companies must update due diligence frameworks for Article 8/9 classification, exit valuations, and financed emissions tracking. Climate-ready startups gain market access advantages in supply chains requiring net zero suppliers.

Sector-Specific Transformation Strategies

Hamburg Port: Decarbonizing Europe's Gateway

The Hamburg Port faces unique climate neutrality challenges. Port policy must balance economic competitiveness with climate action requirements. To achieve climate neutrality by Hamburg 2040, port operations need comprehensive transformation:

- Shore power: Enabling container ships to switch off auxiliary engines during port calls, advancing climate action

- Hydrogen readiness: Infrastructure for importing green hydrogen and ammonia supports climate neutral shipping

- Modal shift: Moving cargo from trucks to electrified rail reduces Hamburg Port emissions

- Circular economy: Processing imported recycling materials in port-adjacent facilities enables circular models

Port policy coordination between the Hamburg Chamber, federal authorities, and port operators determines whether the Hamburg Port can reach climate neutrality while maintaining competitiveness. The Port Development Plan integrates these climate action priorities with economic growth imperatives, ensuring the Hamburg Port reaches net zero without sacrificing its position as Europe's gateway.

Real Estate: Heating Transformation by 2040

Hamburg's fossil fuel boilers phase-out requires replacing approximately 300,000 heating systems to reach climate neutrality years earlier than federal mandates. Heat pumps emerge as the primary technology for climate neutral heating:

- Heat pumps: Primary technology for individual building solutions achieving climate neutral operations

- District heating: Expanding networks using industrial waste heat and geothermal energy

- Building efficiency: Insulation upgrades through energy efficiency measures reduce heating demand

- Solar thermal: Supporting hot water generation in summer months

Investment costs for heat pumps and energy efficiency upgrades range from €15,000-€40,000 per building unit, with funding covering 30-70% depending on building type and technology choice. Early adoption of heat pumps positions property owners for climate neutral operations years earlier than competitors.

Manufacturing: Process Electrification and Circular Models

Hamburg's industry sector must transition from gas-based processes to electricity and renewable hydrogen. Process heat requires electric alternatives for temperatures up to 500°C, while high-temperature applications need green hydrogen. Circular economy approaches reduce primary production needs while supply chain transparency tracks embedded emissions in purchased materials.

Risk Assessment: What Could Go Wrong?

Federal Government Dependencies

Hamburg 2040's success depends on Federal Government delivering critical infrastructure: near-complete grid decarbonization by 2040, hydrogen core networks, sustained financial support, and aligned EU directives. Delays at European or Federal Government level could undermine Hamburg's climate neutrality timeline.

Economic and Technology Risks

Hamburg 2040 could create location disadvantages through higher energy costs, investment flight, supply chain disruptions, and skilled worker shortages. Technology dependencies include heat pumps requiring grid expansion, developing hydrogen infrastructure, CCS availability, and battery-electric truck scaling challenges.

Funding Landscape: Available Support Programs

Hamburg-specific programs include IFB Hamburg "Companies for Resource Protection" (up to 50% subsidy), Green Potential Screening (funding up to €85,000), and planned hardship funding (up to 70% for SMEs). Federal and EU funding through BAFA, KfW, and ERDF support energy efficiency, building renovation, and innovation projects. Funding applications require 3-6 months lead time – early planning secures access before immediate programs trigger increased demand.

Strategic Action Steps by Timeline

Immediate Actions (Next 6 Months)

Calculate current emissions using standardized carbon accounting methods, identify no-regret energy efficiency measures with immediate cost savings, secure funding eligibility for Hamburg and federal programs, and update investor communications to incorporate Hamburg 2040 implications.

Medium-Term Planning (6-18 Months)

Develop transformation roadmaps aligning investment decisions with Hamburg's budget trajectory, assess supply chain climate readiness, pilot heat pump and efficiency technologies, and model impacts of potential immediate programs through scenario planning.

Long-Term Strategy (2-5 Years)

Phase out fossil fuel boilers before mandate deadlines, develop new business models around climate-neutral products and services, redesign operations for circular economy integration, and prepare for physical climate risks alongside mitigation efforts.

Conclusion: Transformation as Opportunity

The Hamburg Future Referendum creates Germany's strictest climate control architecture with binding annual budgets and automatic immediate programs – accelerated five years earlier than federal timelines to reach climate neutrality by Hamburg 2040.

What distinguishes Hamburg's climate action: Munich targets Climate Neutrality five years earlier (2035) but lacks immediate program automation. Berlin aims for 2045 but misses interim targets. Hamburg chooses middle-path timelines with strictest control mechanisms.

Critical success factors: Federal Government support for clean electricity and hydrogen infrastructure, social acceptance through €50-100 million annual hardship funding, technology availability at scale, sufficient skilled workers, and European-level coordination on circular economy standards.

Opportunities for forward-thinking businesses: Innovation leadership in climate-neutral business models, competitive advantages in net zero supply chains, access to green capital, talent attraction through climate action, resilience against fossil fuel volatility, and port-adjacent circular economy opportunities.

Hamburg 2040 carries real implementation risks for energy-intensive industries. However, companies failing to embrace climate action today face stricter requirements tomorrow from Hamburg, Federal Government, EU, or competitive pressures. The transformation to reach climate neutrality requires strategic planning and sustained commitment, but Hamburg's approach offers planning security through clear targets, timelines, and substantial funding. The question for businesses pursuing climate action is how strategically and how quickly to reach net zero.

Your Next Step: Strategic Climate Planning for Hamburg 2040

The Hamburg Future Referendum has passed. Companies acting systematically now will secure funding, avoid immediate program risks, and position themselves as climate-resilient. Hamburg's first estimated balance publishes mid-2027. Companies without baselines by then operate reactively. Funding applications require 3-6 months lead time.

Sources

Freie und Hansestadt Hamburg. (2025). Klimaschutzverbesserungsgesetz mit Gesetzesbegründung. Amtliche Veröffentlichung / Landesgesetzblatt Hamburg.

Hamburg Institut. (2024). Gutachten zur Klimaneutralität Hamburg 2040. Hamburg Institut Consulting GmbH.

IFB Hamburg. (2024). Förderprogramme Unternehmen für Ressourcenschutz. Retrieved from https://www.ifbhh.de/foerderprogramm/ufr-unternehmen-fuer-ressourcenschutz

NDR. (2025, October 12). Zukunftsentscheid: Hamburger stimmen für mehr Klimaschutz. Retrieved from https://www.ndr.de/nachrichten/hamburg/zukunftsentscheid-hamburger-stimmen-fuer-mehr-klimaschutz,zukunftsentscheid-114.html

Zukunftsentscheid Hamburg. (2025). Forderungen: Klimaneutralität 2040. Retrieved from https://zukunftsentscheid-hamburg.de/forderungen/klimaneutralitaet-2040

UNFCCC. (2024). Climate Neutral Now Initiative. Retrieved from https://unfccc.int/climate-action/climate-neutral-now

< p>European Commission. (2024). Corporate Sustainability Reporting Directive (CSRD). Retrieved from https://finance.ec.europa.eu/sustainable-finance/european-green-deal/corporate-sustainability-reporting-directive-csrd_en< /p>Task Force on Climate-related Financial Disclosures (TCFD). (2023). Final Recommendations Report. Retrieved from https://www.fsb-tcfd.org/publications/final-recommendations-report/

Johannes Fiegenbaum

ESG and sustainability consultant based in Hamburg, specialised in VSME reporting and climate risk analysis. Has supported 300+ projects for companies and financial institutions – from mid-sized firms to Commerzbank, UBS and Allianz.

More aboutYou may also like

Biodiversity ESG: Regulatory Frameworks, Risks, and Opportunities for 2030

Biodiversity in ESG is rapidly shifting from voluntary reporting to mandatory compliance. Companies...

Supply Chain Risk Management: Strategic Framework for Resilience and Compliance in 2026

Supply chain risk management has evolved from a compliance obligation into a strategic imperative...