9 min read

VSME vs ESRS Reporting for US Companies: EU Compliance Guide 2026 [Which Module?]

By: Johannes Fiegenbaum on 5/26/25 10:03 AM

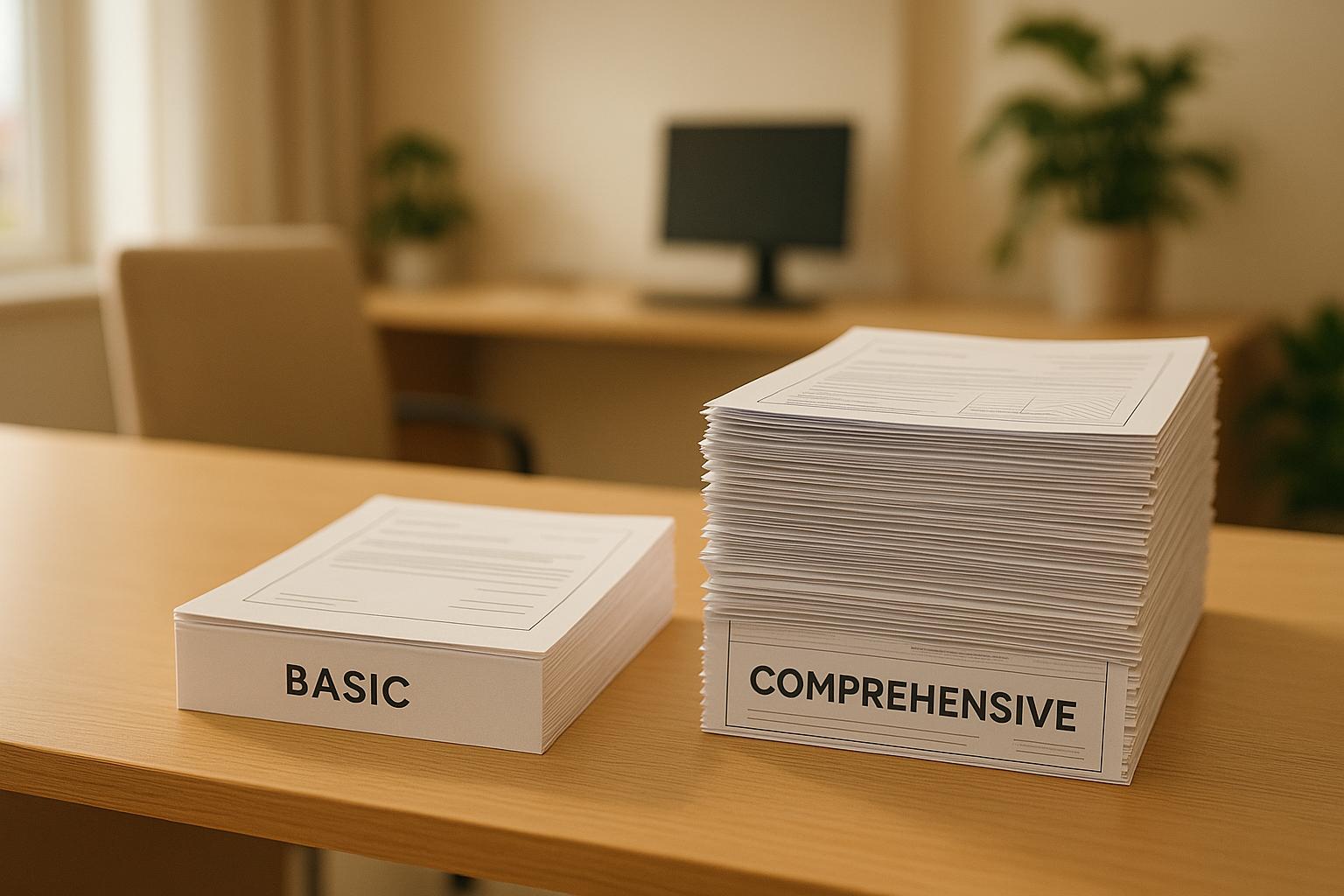

The VSME (Voluntary Sustainability Reporting Standard for non-listed SMEs) offers two pathways: the Basic Module with 11 core indicators, and the Comprehensive Module with 20+ sustainability metrics. For US companies with European customers, operations, or investors, VSME has transformed from obscure EU regulation into strategic competitive factor—even without direct compliance obligations.

This guide demystifies VSME for American business leaders, comparing it with familiar frameworks like TCFD and ISSB whilst providing decision frameworks that balance European stakeholder expectations with US business realities.

Key Takeaways for US Companies

- VSME reporting affects US suppliers to European companies regardless of direct EU obligations

- February 2026 EU Omnibus Package narrowed CSRD scope but strengthened VSME's role as SME standard

- Basic Module satisfies most European customer requirements with 40-60 hours initial investment

- Comprehensive Module positions companies for European expansion and sophisticated investor requirements

- VSME aligns substantially with TCFD and ISSB while addressing European-specific expectations

Do US Companies Need VSME Reporting?

VSME obligations don't apply directly to US-domiciled companies without European operations, but practical pressures create compelling rationales for voluntary adoption across multiple scenarios intensifying through early 2026.

When VSME Becomes Mandatory for US Operations

EU Subsidiaries Exceeding CSRD Thresholds: Following the February 2026 EU Omnibus Package, thresholds increased to 1,000+ employees and €450 million revenue. Companies exceeding these must implement full ESRS reporting. However, many US subsidiaries now fall below revised thresholds yet still face stakeholder expectations—VSME provides proportional response without full CSRD complexity.

European Customer Supply Chain Requirements: Large European corporations subject to CSRD must report value chain emissions and ESG risks throughout their supply chains. This creates cascading transparency requirements affecting US suppliers regardless of size. Rather than responding to divergent custom questionnaires from each European customer, VSME provides standardized reports satisfying most requirements.

The VSME "Shield Function" for US Suppliers

The February 2026 Omnibus Package introduced critical protection: Large companies subject to CSRD cannot demand more sustainability data from SME suppliers than VSME defines. This legislative "shield" transforms VSME from voluntary guideline into strategic compliance ceiling. US companies can confidently reference VSME when negotiating with European customers, rejecting excessive demands with regulatory backing.

Strategic Voluntary Adoption Scenarios

European Market Expansion: US companies planning European entry find VSME signals sophistication familiar to European customers and investors—particularly valuable in renewable energy, sustainable technology, and climate adaptation sectors.

Investor Relations: European institutional investors and venture capital firms increasingly apply ESG criteria developed for European markets. VSME-aligned reporting demonstrates sustainability sophistication whilst US frameworks like SEC climate disclosure face implementation uncertainty. This resonates particularly with funds under SFDR Article 8 or 9 classifications requiring portfolio ESG data.

Comparing VSME to US Sustainability Frameworks

VSME vs. TCFD

| Dimension | TCFD | VSME Comprehensive |

|---|---|---|

| Scope | Climate only | Climate + social + governance |

| Materiality | Financial only | Double materiality |

| Scope 3 | Optional | Mandatory |

US companies with existing TCFD implementation find VSME Comprehensive Module requires incremental work primarily around Scope 3 emissions, social metrics, and impact materiality—rather than complete framework overhaul.

VSME vs. ISSB Standards

ISSB Standards share substantial alignment with VSME, enabling coordinated reporting approaches. Key difference: ISSB focuses on investor decision-making with financial materiality only, whilst VSME addresses multi-stakeholder transparency with double materiality. US companies can satisfy both through integrated reporting—implementing ISSB as foundation, then supplementing with VSME-specific social and governance metrics.

VSME Basic Module: Foundation for US Market Entry

Core Indicators

The Basic Module's 11 indicators span essential ESG dimensions:

Environmental: Energy consumption, GHG emissions (Scope 1 & 2), waste management, environmental compliance

Social: Workforce structure, training hours, health & safety, collective bargaining coverage

Governance: Anti-corruption policies, business ethics, compliance mechanisms

US companies typically find 60-75% of required data already exists within utility billing systems, HRIS databases, EHS management systems, and financial accounting platforms.

Implementation Roadmap

Weeks 1-4: Data inventory mapping existing sources to VSME requirements

Weeks 5-8: Process design establishing workflows with clear ownership

Weeks 9-12: Technology evaluation (spreadsheets for Basic, platforms for Comprehensive)

Weeks 13-16: Report development and optional external assurance ($3,000-$6,000)

Total investment: 40-60 hours internal time plus $5,000-$15,000 external consulting for most mid-sized companies.

When Basic Module Suffices

- Limited European revenue exposure (< 30% of total)

- Supplier role rather than strategic partner relationships

- Resource constraints (< 100 employees, no dedicated sustainability personnel)

- Testing European market opportunity without overcommitment

VSME Comprehensive Module: Strategic Positioning

Enhanced Requirements Beyond Basic

Advanced Climate Reporting: Scope 3 value chain emissions (15 GHG Protocol categories), climate risk assessment, science-based reduction targets, transition planning. US-specific challenge: Scope 3 requires supplier engagement for primary emissions data—often difficult with decentralized US supply chains.

Expanded Social Metrics: Gender diversity across organizational levels, living wage analysis, human rights due diligence, community engagement. Cultural translation needed: European stakeholders interpret US labor relations (low union coverage) differently—contextualize alternative employee representation mechanisms.

Circular Economy: Material circularity indicators, resource efficiency metrics, product lifecycle management, take-back programs.

Enhanced Environmental: Biodiversity impact assessments, water consumption in stressed areas, pollution prevention beyond GHGs.

Implementation Investment

Costs: $15,000-$25,000 consulting, $8,000-$20,000 annual technology platforms, 80-120 hours internal time, $5,000-$10,000 optional assurance. Total first-year: $28,000-$55,000.

Quantifiable Benefits:

- 20-30% higher European customer retention vs. competitors

- 25-50 basis point interest rate reductions on sustainability-linked loans

- 5-10% M&A valuation premium for ESG-mature companies

- 10-15% operational efficiency improvements ($50,000-$150,000 savings annually)

When Comprehensive Justifies Investment

- Significant European revenue (> 30% of total)

- Active fundraising or European expansion planning

- Strategic European partnerships (joint ventures, exclusive distribution)

- ClimateTech/sustainability-focused business models requiring credibility

- Fast growth approaching potential CSRD thresholds

2026 Regulatory Context: EU Omnibus Impact

The February 2026 EU Omnibus Package fundamentally recalibrated European sustainability reporting. Original CSRD anticipated 50,000 covered companies; Omnibus narrowed scope by approximately 80% through threshold increases (250 to 1,000+ employees, €50M to €450M revenue).

VSME's Elevated Strategic Role

Rather than diminishing sustainability importance, Omnibus elevated VSME through three mechanisms:

1. Shield Function Codification: Legislative language prohibits large CSRD companies from demanding more supplier data than VSME defines—transforming voluntary guideline into protective standard.

2. Market Standardization: With 40,000+ companies newly exempt from CSRD, VSME emerged as de facto SME standard through market forces.

3. Financial Institution Integration: European banks increasingly integrate VSME criteria into lending decisions, particularly sustainability-linked products.

Implementation Timeline

- 2026: Large European customers begin requesting VSME-aligned supplier data

- 2027: VSME becomes expected standard for European-facing SMEs

- 2028: Wave 2 companies begin mandatory CSRD reporting, intensifying supply chain data requests

- 2030: Full implementation including comprehensive Scope 3 transparency

Technology Landscape: 2026 Platforms

Comprehensive Enterprise Solutions: EcoVadis ($12k-30k annually), Normative ($15k-35k), Sweep ($10k-25k) offer end-to-end ESG management with VSME modules.

SME-Focused Platforms: Plan A ($8k-18k), Greenly ($6k-15k), Watershed ($12k-22k) provide simplified interfaces good for Basic Module implementations.

AI-Powered Emerging Capabilities: Automated Scope 3 screening (40-60 hours reduced to 4-6 hours), natural language policy processing (85%+ accuracy), real-time emissions monitoring, automated supplier engagement (3x higher response rates).

Financial Institution Pressure: SLL Conditions

European banks originating $150+ billion sustainability-linked loans annually increasingly structure products around VSME-aligned metrics (GHG reduction targets, renewable energy percentage, waste diversion, diversity improvements). VSME compliance enables favorable financing terms—15-30 basis point advantages versus non-reporting competitors.

For US companies with $10+ million European-sourced debt, VSME Comprehensive Module potentially saves $15,000-$45,000 annually in reduced interest expense—directly offsetting implementation costs within 12-24 months.

Deep-Dive Resources: Understanding the VSME Framework

Essential Reading for VSME Implementation

Complete Overview of ESRS Standards: Key Reporting Guidelines for Corporate Sustainability under CSRD →

Why read this: VSME simplifies full ESRS requirements. This guide covers all 12 ESRS standards with detailed disclosure requirements, helping US companies anticipate European customer expectations and evaluate Comprehensive Module adoption.

ESRS E1 Implementation Guide: Mastering Climate Reporting Requirements →

Why read this: Climate reporting forms the most technically demanding VSME Comprehensive component. This guide provides step-by-step GHG accounting, climate risk assessment, and transition planning methodologies exceeding typical US TCFD implementations.

Frequently Asked Questions

Does VSME apply to US companies without European subsidiaries?

VSME doesn't apply directly, but US suppliers to European customers increasingly receive VSME-aligned ESG questionnaires. Proactive implementation provides standardized responses satisfying most requirements whilst positioning for European investor and bank expectations.

How does VSME Basic Module compare to typical US ESG reporting?

VSME Basic covers similar ground to CDP, GRI-lite, or basic SASB but requires double materiality assessment (financial + impact perspectives), European social metrics (collective bargaining), and standardized structure facilitating cross-company comparison.

Can US companies use VSME to satisfy SEC climate disclosure rules?

VSME and SEC rules serve different purposes with limited overlap. SEC focuses on climate-related financial risks; VSME addresses broader ESG including social/governance. However, VSME Comprehensive climate disclosures substantially align with SEC proposals—companies can leverage data for both with incremental effort.

Should technology companies prioritize VSME given primarily digital operations?

Yes. European customers scrutinize technology providers' Scope 2 emissions (data centers), Scope 3 emissions (supply chain, business travel), workforce diversity, and governance (data privacy, AI ethics). VSME Basic addresses these priorities with manageable effort.

What external assurance do European stakeholders expect?

VSME doesn't mandate assurance, but third-party verification substantially enhances credibility—particularly important for US companies facing skepticism. Limited assurance typically costs $3,000-$10,000. Companies serving large corporate clients or seeking European financing benefit disproportionately.

Can US companies transition from Basic to Comprehensive Module mid-year?

VSME's modular structure supports progression, with companies frequently transitioning within 12-24 months. Mid-year transitions prove feasible but complicate year-over-year comparison. Most successful transitions align with fiscal year boundaries maintaining clean reporting periods.

Next Steps: Implementing VSME for Your Organization

Immediate Actions (Next 30 Days)

- Survey European customers/investors regarding ESG data requirements

- Conduct preliminary data inventory mapping to VSME requirements

- Present VSME strategic rationale to CFO/COO securing sponsorship

- Review competitor sustainability disclosure identifying norms

Near-Term Planning (Next 90 Days)

- Make module selection decision using framework above

- Develop implementation roadmap with clear milestones

- Evaluate technology platforms (3-4 vendor demonstrations)

- Secure budget presenting ROI analysis

Expert Support for VSME Implementation

Fiegenbaum Solutions offers specialized support for US companies implementing VSME, combining regulatory knowledge with practical execution:

- Strategic assessment and module selection rationale

- Data infrastructure design balancing requirements with efficiency

- Double materiality assessment integrating US risk frameworks

- High-quality report development satisfying European and American stakeholders

- Assurance preparation and cultural translation guidance

Schedule VSME Strategy Consultation

Additional Resources

Supporting Implementation Guides

- Sustainability Reporting Benefits for SMEs: Business case analysis with European customer retention metrics

- Prioritizing ESG Topics Using Double Materiality: Practical materiality assessment guide

- Scope 3 Emissions Accounting for SMEs: Value chain emissions methodologies

Interactive Assessment Tools

- VSME Readiness Assessment: Evaluate organizational preparedness

- Scope 3 Quick Check: Preliminary value chain emissions assessment

- CSRD Materiality Screening: Interactive double materiality tool

- Climate Risk Assessment: Physical and transition risk evaluation

Johannes Fiegenbaum

ESG and sustainability consultant based in Hamburg, specialised in VSME reporting and climate risk analysis. Has supported 300+ projects for companies and financial institutions – from mid-sized firms to Commerzbank, UBS and Allianz.

More aboutYou may also like

Comprehensive Guide to CSRD: Reporting Water and Climate Risks for German Companies

The Corporate Sustainability Reporting Directive (CSRD) introduces new, binding requirements for...

Streamline Your ESG Reporting with the VSME Standard: Efficient, Automated, and Compliant

Want to make your ESG reporting more efficient? With the VSME Standard, you can create leaner and...